Top token bitcoin last week hit $31,818, its highest for a year, and is up more than 80% in price so far in 2023. However, the asset remains less than half its all-time high of $69,000.

(Reporting by Tom Wilson in London; Editing by Sharon Singleton)

The move comes at a time when the global cryptocurrency industry has been caught in the crosshairs of the U.S.

securities regulator on alleged violations of securities laws.

Binance.US, the purportedly independent partner of Binance, said in a tweet on Thursday that its banking partners were preparing to stop dollar withdrawal channels as early as June 13.

The Reserve Bank of Australia was in no mood to hold off, however.

It raised interest rates by a quarter-point on Tuesday to an 11-year high and warned further tightening may be required to ensure that inflation returns to target, boosting the Aussie dollar as markets had been leaning towards a pause.

The CFTC sued Binance, Zhao and former Chief Compliance Officer Samuel Lim in March, alleging they violated the Commodity Exchange Act and certain related federal regulations, and for operating what the regulator said was an “illegal” exchange and a “sham” compliance program.

Conversely, one can track performance and understand all the trades executed in the past.

In addition, traders also stand to access all the information about the trading activity as well as all trades processed in the platform.

The world’s biggest cryptocurrency was last at $25,723, near a more than two-month low.

The lawsuits have rocked the crypto markets and Bitcoin fell more than five percent on Monday, its worst daily decline since April 19.

The U.S. government is expected to rush to sell short-term debt to replenish its Treasury General Account (TGA), potentially at yields so high that banks raise deposit rates to compete for funding, reducing interest in riskier assets like equities.

Helped by a surge in Tesla Inc, which jumped as much as 5.7%, the S&P 500 rose to levels last seen in August before receding by mid-day to be little changed.

The Nasdaq Composite and the Dow Jones Industrial Average also pared earlier gains to stand flat.

The world’s biggest asset manager, BlackRock, filed to launch a bitcoin exchange traded fund last month and earlier in July exchange operator Cboe refreshed its filing for a similar fund to be run by asset manager Fidelity.

“There’s a bit of a mixed picture right now and some of the central banks that have earlier gone into a pause — looks like it’s not really a pause, but more of a skip, and this may be what we’re getting with the Fed as well,” said Moh Siong Sim, a currency strategist at Bank of Singapore.

In its complaint filed in Manhattan federal court, the SEC said Coinbase has, since at least 2019, made billions of dollars by operating as a middleman on crypto transactions, while evading disclosure requirements meant to protect investors.

SEC officials followed the step with another suit against fellow exchange Coinbase on Tuesday morning, accusing it of illegally operating without having first registered with the regulator.

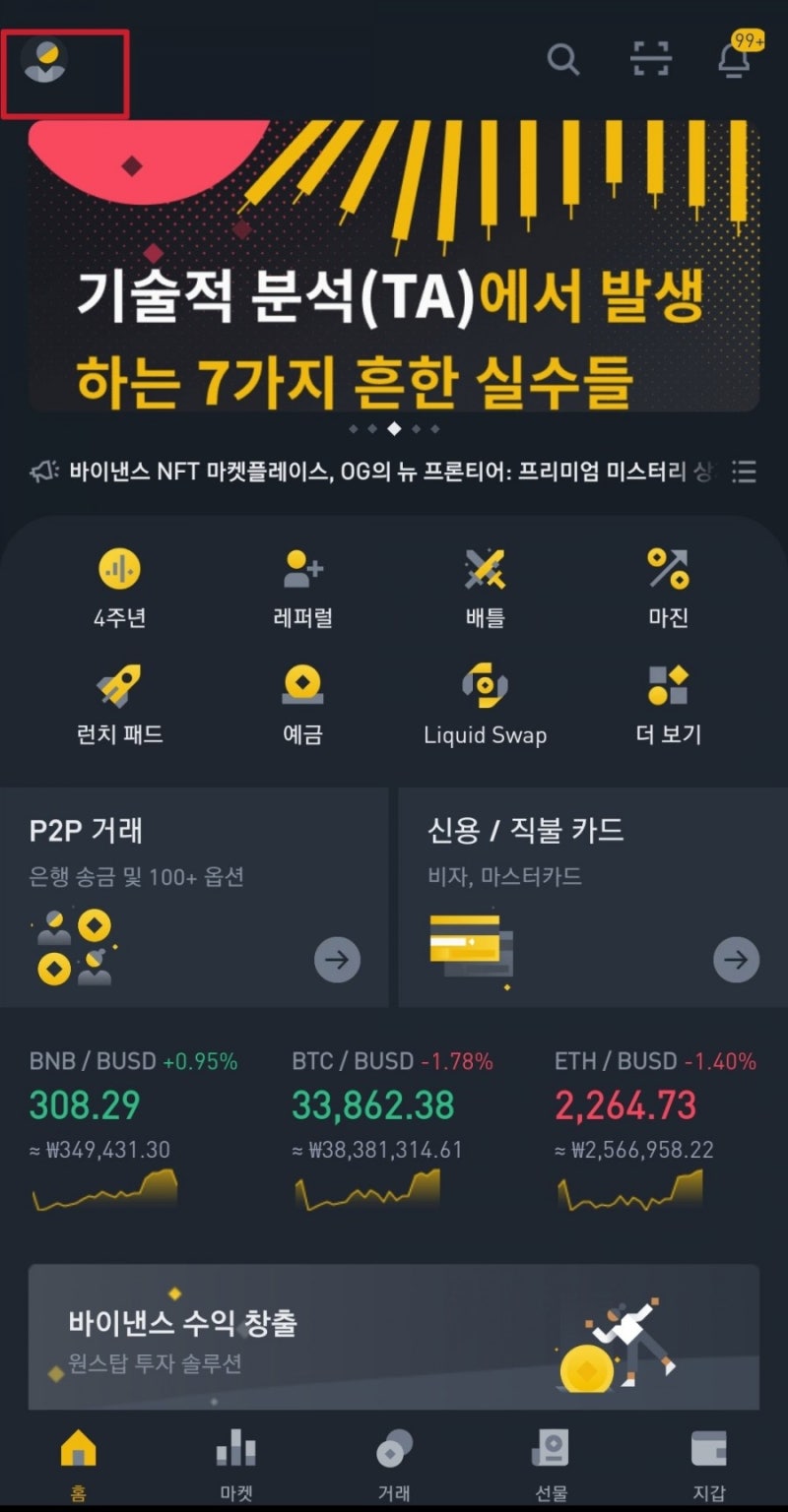

However, the market sees an increase as mostly assured by the July 26 decision, 바이낸스 레퍼럴 (original site) putting the chance at about 80%. Traders now lay 73% odds for the Fed to keep rates steady on June 14, versus 27% probability of a quarter-point increase.

An outstanding example of this is a GameFi marketplace like Rainmaker Games. They can rely on each other to support Web2, Web3, and other players. As a result, some of them are marketing themselves as both a marketplace for NFTs and a gaming storefront.

The regulator alleged in 13 charges that the exchange artificially inflated its trading volumes, diverted customer funds and failed to restrict US customers from its platform.

PancakeSwap is the biggest decentralized exchange (DEX) that runs on the Binance Smart Chain (BSC). It is based on an Automated Market Making (AMM) system. The platform is a fork of Sushi Swap, a DEX built on the Ethereum blockchain.

BlackRock’s iShares Bitcoin Trust will use Coinbase Custody as its custodian, according to a filing with the U.S.

Securities and Exchange Commission (SEC). regulator has yet to approve any applications for spot bitcoin ETFs.

Elsewhere, the Turkish lira hit a new record low overnight of 23.54 per dollar, even as President Tayyip Erdogan’s appointment of a U.S.

banker as central bank chief sent a strong signal for a return to more orthodox policy.