General Counsel Hon Ng has also quit, Fortune and Bloomberg News reported on Thursday, with both outlets citing a person familiar with his departure.

Yibo Ling, Binance’s U.S.-based chief business officer, has also left, Bloomberg reported.

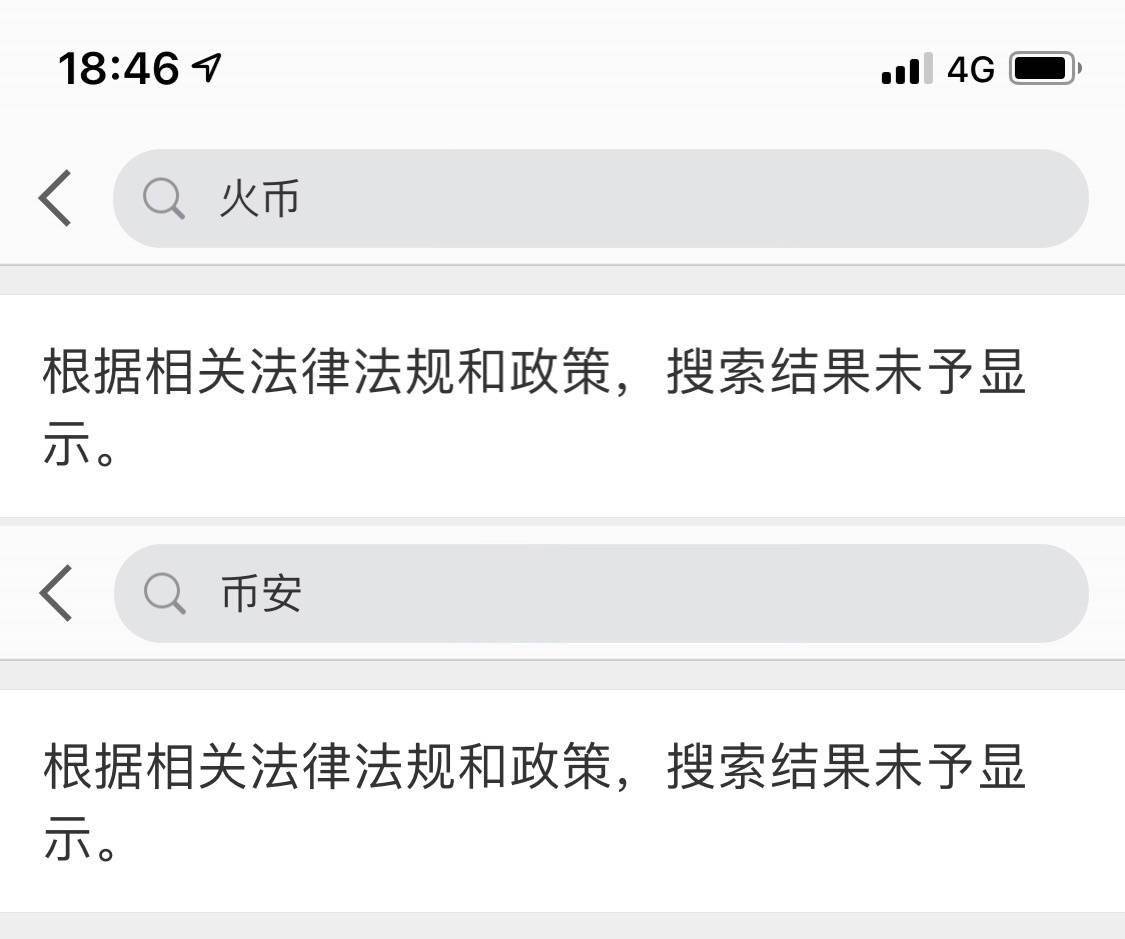

Securities and Exchange Commission for allegedly breaching the regulator’s rules, pushing its global market share to 52% from 60% at the start of the year, according to data firm Kaiko. Last month, Binance was hit by a lawsuit by the U.S.

Securities and Exchange Commission for allegedly breaching the regulator’s rules, pushing its global market share to 52% from 60% at the start of the year, according to data firm Kaiko. Last month, Binance was hit by a lawsuit by the U.S.

July 5 (Reuters) – The market share of Binance, the world’s largest cryptocurrency exchange, and its U.S.

affiliate have shrank this year, as they battle an onslaught of regulatory crackdowns.

Binance.US, the purportedly independent partner of Binance, has seen its U.S.

market share slump to 0.9% on June 26 from over 22% in April after the exchange gave its customers a deadline of June 13 to withdraw their dollar funds as the SEC asked a court to freeze its assets.

Bucking the trend, Coinbase’s U.S.

market share jumped in June to 55% from 48.4%, as the exchange was named as a surveillance partner by Fidelity and other asset managers in filing for 币安注册 (made my day) a spot bitcoin ETF, Aubert said.

Zhao, a billionaire who is one of crypto’s most powerful figures, said in a tweet on Friday: “Yes, there is turnover (at every company). But the reasons dreamed up by the “news” are completely wrong.”

July 6 (Reuters) – A string of executives have quit Binance, according to their tweets and media reports, the latest blow for the world’s biggest crypto exchange as its battles a slate of legal and regulatory headaches.

Commodities Futures Trading Commission (CFTC) sued Binance and its founder Changpeng Zhao in March for operating what the regulator alleged was an “illegal” exchange. The world’s largest cryptocurrency exchange is battling regulatory suits and probes around the world.

The U.S.

Fortune, citing a person at Binance familiar with the situation, reported that the executives quit over Zhao’s response to the Justice Departure probe.

Reuters could not independently confirm this.

SYDNEY, July 5 (Reuters) – The Australian securities regulator searched Binance Australia’s offices on Tuesday as part of a probe into its recently closed derivatives business, Bloomberg News reported on Wednesday.

The Australian Securities and Investments Commission, the corporate and securities watchdog, searched Binance Australia’s office on Tuesday, Bloomberg reported, citing unnamed sources.

ASIC’s investigation, first confirmed in February, concerns the misclassification of retail investors as wholesale.

The former are entitled to a higher level of regulatory protection.

The world’s largest cryptocurrency exchange closed its Australian derivatives business and relinquished a financial services license in April amid an ASIC probe into the business.

A spokesperson for Binance told Reuters the company is “cooperating with local authorities” and focused on “meeting local regulatory standards”, but did not confirm the search.

Hillmann, who joined Binance in 2021 as its top communications executive, became its chief strategy officer in October last year.

After Zhao, he was Binance’s most outspoken advocates on social media.